Following a survey conducted by BeanScene’s publisher, Prime Creative Media, we reveal the latest stats from businesses in the coffee industry as we battle through COVID-19 and move into a new normal.

Australia is an outlier in global economic performance. For the past 29 years, the country has defied global trends, avoiding recession with 29 years of continuous growth according to the Australian Trade and Investment Commission. Australia has outperformed all 34 member countries of the Organisation for Economic Cooperation (OECD). Even the Global Financial Crisis from 2007 to 2009 couldn’t hurt performance, as the economy continued to grow largely thanks to direct injections of cash from the federal government to residents.

The result is that at least 3.5 million working age Australians have never lived in a recession, while another approximately 9.1 million working age Australians have never been in the workforce during one. This all changed in June 2020, where the might of Australia’s economic muscle was weakened following the lockdowns to contain the coronavirus pandemic.

At the start of the lockdown, even conservative estimates said this downturn was inevitable. While there was some hope major stimulus packages might heed a recession, once major events were cancelled, international travel banned, and tourism put to halt, few believed the country could avoid it.

The recession has arrived, and the question now is: how fast will Australia’s economy recover? To help answer this question, from 28 May to 5 June 2020, Prime Creative Media, Australia’s leading B2B publisher, undertook an ambitious industry sentiment survey across more than 490,000 readers and its 29 brands, to measure business performance and confidence among the key industrial sectors we serve.

One of those sectors was the coffee industry, undoubtedly among the worst hit by the coronavirus restrictions. The purpose of the survey was to reflect on where the coffee industry is placed as the national and global economies start to emerge from this once-in-a-generation challenge.

A wide variety of people across executive, mid-level manager, finance, sales and marketing, procurement and operations participated in the industry survey representing BeanScene and Global Coffee Report audiences.

Forty-four per cent of survey respondents had up to 10 employees in their company, while 25 per cent had between 11 to 50 employees, and 11 per cent between both 51 to 100 and 101 to 500. On the other end of the scale, just 6 per cent had more than 500 employees.

These results can be attributed to Australia’s coffee industry being largely made up of small boutique businesses, stretching across both metro and regional locations.

According to the Australian Bureau of Statistics (ABS), more than a quarter of all jobs in accommodation and food services were lost between mid-March and the first week of April.

Those aged 20 to 29 and over 70 were the worst affected by the job cuts in the accommodation and food services sector, with more than 40 per cent losing work. As of 18 June, unemployment had reached a 19-year high, sitting at 7.1 per cent.

Many had access to JobKeeper, however the Australian Financial Review reported in May that only half of the hospitality sector had enrolled for the government’s JobKeeper payments, despite the industry being among the worst impacted by coronavirus restrictions. Some businesses struggled with enrolment or didn’t make the cut, and many of the industry’s casual and foreign workers were omitted or ineligible.

Released Treasury data showed 51,269 employers in the accommodation and food sector had enrolled for the wage subsidy by 4 May, out of a total 728,640 applications. But the figure represented just 53.8 per cent of the businesses operating in the sector, as recorded in February by the ABS.

There are already calls for the $70 billion JobKeeper wage subsidy scheme to be extended until the end of the year, with the sector facing a long road to recovery.

A CHALLENGING TIME

When it came to describing the impact COVID-19 has had on individual businesses, 40.5 per cent of respondents said it was somewhat negative, while 37.6 per cent said very negative, and 12.8 per cent had not seen a lot of impact. Only 8.9 per cent said they had seen some increase in business.

For those businesses who had experienced a downturn, at the conclusion of the May-June survey, an optimistic 34 per cent of survey respondents said they expected their companies to return to previous levels in the next six to 12 months. Twenty per cent said three to six months, and more than 12 months, while 13 per cent said timing wasn’t applicable. Just 12 per cent of respondents expected business to bounce back within one to three months.

While this may be the case for some states, unfortunately at time of print in mid-July, a second wave of COVID-19 was imminent, with Metropolitan Melbourne facing record case numbers, and forced into stage three lockdowns again. Once again, Melbourne hospitality businesses felt the strain just after they’d welcomed back dine-in patrons. And, for the first time in 100 years since the Spanish flu pandemic, borders between Victoria and New South Wales closed on 9 July.

With the survey sent out just as initial restrictions were starting to lift across the country, results picked up a strong appetite for a quick recovery. In terms of hiring intentions in the next 12 to 24 months, a total 37.6 per cent of survey respondents said they don’t expect to create new positions. Twenty-three per cent said they would operate with a reduced number of staff and the same percentage said they hoped to create more positions within the next 12 months. Only 15.5 per cent had hope of rehiring any laid off or stood down staff.

Most impressive in response to the lockdown has been the coffee industry’s ability to adapt to its ‘new normal’ and think outside the box in terms of operational abilities and ways to reach their target market.

This includes an increased demand in retail coffee from both café volumes and supermarkets sales as Australian households increased their caffeine intake (see more page 30). Then, there was the uptake of online and app-based ordering systems to help cafés remain operational as takeaway- and delivery-only.

Cashless payment systems also accelerated, and for some businesses, “pivoting” meant diversifying its businesses operations to incorporate groceries and hand sanitiser manufacturing – anything to help retrieve the loss of income from traditional methods of sales.

This sentiment for versatility and adaptability was felt across the coffee sector at the time of our May-June survey. Half of respondents said they were exploring new technologies and services to make their companies more productive and efficient in the next 12 to 18 months. However, 35 per cent said they will continue current projects and not make any new investments, and 14.5 per cent said they would cut or reduce all of their investment and research and development.

INDUSTRY ENGAGEMENT

As major news outlets continue to report on the strains the supply chain is experiencing and show a general perspective on the hospitality industry, BeanScene’s close relationships with leading decision markers, coffee suppliers, roasters, café operators, and baristas have given the publication exclusive access to content and stories.

To help suppliers in marketing to those companies that are looking to make investments, we polled respondents on what sources they use to make purchasing decisions. Information given directly from suppliers was the most influential source of information to make a purchasing decision during this time, followed by case studies about companies similar to their own.

A high portion of respondents said that information from third-party sources such as trade magazines and industry reports and trade events had been highly beneficial over direct advertising from social media platforms such as Google or Facebook.

The majority of respondents rated social media as the least trustworthy source during recent times, rating last by the highest margin among all the sources listed. Emailed newsletters and media websites rated moderately to highly trustworthy, and the most trustworthy source according to industry is trade magazines and periodic journals.

Following the generally accepted advice that it’s important to maintain share of voice in a downturn, an impressive 42 per cent of survey respondents said they had maintained their level of marketing. Twenty-six per cent had increased their level of marketing, and 25 per cent had made a reduction in their level of marketing. Only 5 per cent cut all marketing spend altogether.

In addition to media trust, the survey also polled respondents on industry events, to help companies plan how to incorporate live events in their future marketing plans. Although many physical industry trade events have been cancelled or postponed until further notice, a very healthy 40.9 per cent of respondents said they are likely to attend trade events in the future, when the government deems it to be safe. Thirty-five per cent said very likely, and just 23.7 per cent said not very likely.

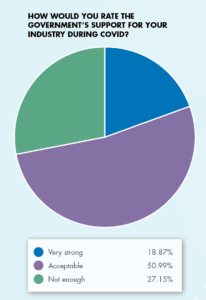

Half of respondents rated the Federal Government’s support from the sector during the COVID-19 crisis as acceptable, however with cafés forced to shut down or limit their businesses, 27.1 per cent of survey respondents were critical, saying the governments didn’t do enough. On the other hand, 18.8 per cent said it was very strong.

The Federal and State Governments were quick to release a range of support programs and stimulus packages for small businesses struggling during the coronavirus pandemic. This included the Federal Government’s $130 billion JobKeeper Payment scheme to help keep more Australians in jobs, and a code of conduct and moratorium on evictions for commercial leases, meaning many small businesses that were uncertain of the future will live to see another day.

The Federal Government provided up to $100,000 to eligible small and medium-sized businesses that employ people, with a minimum payment of $20,000. State governments have also provided financial support to businesses, but there’s still more to be done.

Confidence is a tough thing to shake. With Australia’s long history of economic might, it seems that even a recession can’t hold back the confidence of businesses in some of Australia’s most important industries.

The economy is experiencing one of the worst crisis to impact the industry since the post-World War II era. COVID-19 has already shut down millions of businesses globally, with a good percentage unlikely to reopen. We hope that our beloved cafés, as well as roasteries, traders and suppliers, find the strength to withstand the lockdowns and stand stronger together on the other side.

And while confidence is no crystal ball to predict the future, it forms an important part of our path back to prosperity. ‘Animal Spirits’, the term coined by British economist John Maynard Keynes, highlights that the instincts and emotions that guide our behaviour can have a significant impact on the economy. The results of this survey show that many business leaders in key sectors are eager to continue marketing and invest in their businesses, in the hopes we’ll return to normal in less than 12 months. This attitude will form an important part of making that belief a reality.

This article appears in the August 2020 edition of BeanScene. Subscribe HERE.