Following on from a survey diving into coffee prices, Pablo & Rusty’s has conducted another investigation into the habits and rituals that drive Australian coffee consumers. CEO Abdullah Ramay discusses the results.

In our initial analysis, we focused on the vital topics of price tolerance and value perception. But the full picture of the Australian coffee landscape is far richer, revealing fascinating insights into when and where Australians are drinking and how preferences subtly shift between the states.

Our comprehensive survey of 789 Australian coffee drinkers confirmed one thing: coffee isn’t just a beverage; it’s a non-negotiable daily ritual, but the way we access it is complex and highly habitual.

Coffee is a routine

The modern Australian consumer operates within a dual coffee economy: home consumption and the café ritual.

Frequency is high and loyal

Forget the occasional treat. Almost half of Australians buy from a cafe daily or multiple times a week. For many, it is the most consistent discretionary spend in their day. That frequency changes how people think about price. A single cup might feel inexpensive. Multiplied across a week or a month, it becomes meaningful.

This explains why consumers are price aware, but not price led. They want reassurance that what they are buying is worth repeating.

The home vs. cafe ecosystem

While the café remains a hub, the home is the primary location for coffee consumption for the majority of Australians. However, this isn’t a zero-sum game. The cafe provides the aspiration and the home provides the convenience.

When Australians do leave the house, the data shows their choices are anchored by routine:

- 19 per cent of coffee is purchased at a café near home.

- 17 per cent is purchased at a café near work.

This means that while consumers have a high standard for quality, they often prioritise the convenience of their predictable routes. The opportunity here is to ensure the quality (and experience) of the coffee is the consistent element that makes your café the obvious choice on the commute or the local favourite on the weekend.

The psychology of pricing: Anchor points and education

Beyond our initial findings on upper price limits, the survey revealed the deep psychological anchors that govern the conversation around cost.

The true price anchor is lower than reality

When asked to nominate a fair or bargain price for a small hot coffee, responses clustered tightly around $4.50 to $5.00. The statistical optimal price landed at $4.88. This is not because Australians think coffee is cheap to make. It is because this range has become the cultural reference point.

Prices have moved slowly for a long time, while costs have not. The data shows a narrow acceptable range. Move too far below it and quality is questioned. Move too far above it and value anxiety sets in. This is the tension cafe owners live with every day.

We expect this to change in the coming months as the average coffee price for a small flat white in many cities now exceeds $5.

Education changes everything

Most customers are unaware of how low the prices in Australia are compared to global cities. Many assume coffee costs the same in most OECD countries. One of the most powerful findings came from a single line of context. When respondents were told that in many comparable international cities a small coffee costs between $9 and $10, willingness to pay shifted sharply.

The new optimal price moved from $4.88 to $6.71. A lift of 37.5 percent. Nothing about the product changed. Only understanding did.

This matters. It shows that resistance to higher prices is not fixed. It is often driven by incomplete information. When customers understand the global context, the craft, and the inputs, their expectations recalibrate.

The friendly rivalry: A tale of three states

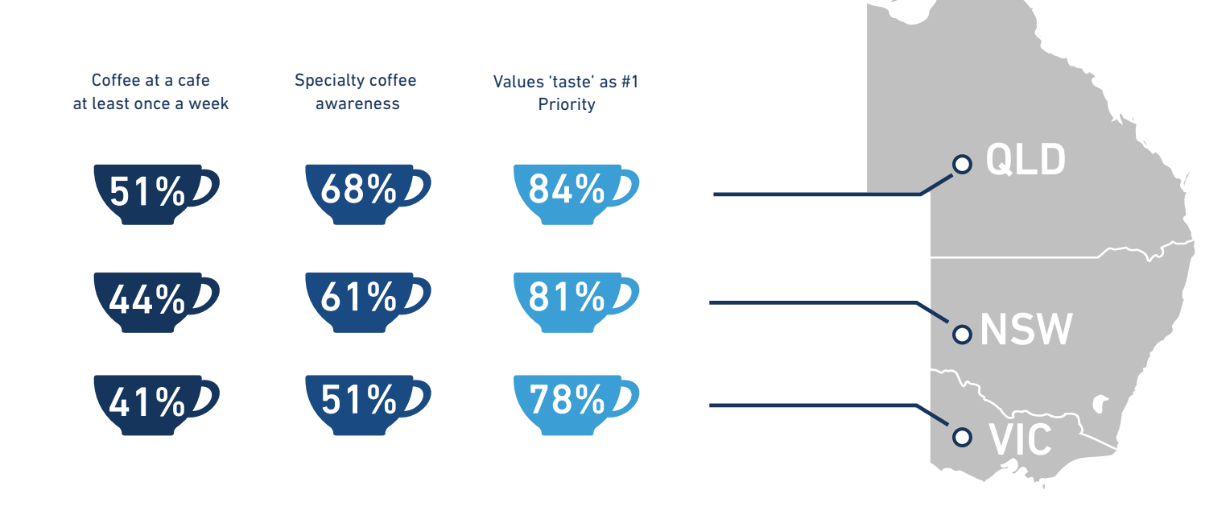

While the love for coffee is national, our survey highlighted some intriguing differences in habits and awareness between the major coffee markets of Queensland, New South Wales and Victoria.

Queensland (QLD): The frequent drinkers: QLD stands out as the state where the café ritual is strongest, with the highest percentage of residents visiting a cafe at least once a week. They are highly engaged and prioritise quality, with 84 per cent rating taste as their top priority.

New South Wales (NSW): The aware market: NSW scores high in “Specialty Coffee” awareness (61 per cent), just behind Queensland, indicating that consumers here are slightly more informed about industry terminology. They balance frequent visits with a strong drive for taste (81 per cent).

Victoria (VIC): The Quiet Connoisseurs: Surprisingly, Victorians reported the lowest weekly café visit frequency (41 per cent) and the lowest awareness of the term “specialty coffee” (51 per cent). However, as the initial blog post suggested, consumers associate “specialty” with tangible quality. The lower awareness here likely means the expectation for high quality is simply the default. Taste is still overwhelmingly important to 78 per cent of respondents, proving that in this fiercely competitive market, quality is the fundamental price of entry.

NB: These state based results are not statistically significant, yet they are still worth exploring.

Beyond taste: The pillars of service and consistency

While taste and quality are the undisputed leaders, a deep dive into the secondary drivers of café choice reveals what truly secures customer loyalty and repeat business. Following taste, the most important factors ranked were price/value, consistency and cleanliness.

Taste, value and consistency still win

Taste and quality sit firmly at the top. Value follows closely, not as cheapness but as fairness. Consistency rounds out the top tier. Ambience, brand, sustainability and even speed matter, but they trail behind the cup itself. This is a reminder that pricing power does not come from signage or fit outs. It comes from what ends up in the hands of the customer, every single time.

For the frequent café visitor, consistency is king. Knowing that the same drink will taste the same yesterday, today, and tomorrow builds trust and removes decision fatigue from a busy routine.

What this means for specialty cafes

Customer experience and operational excellence is your insurance policy. Once you have nailed the taste, protecting that investment requires rigorous staff training, unwavering adherence to service standards and maintaining a spotless environment. These elements are ‘experience multipliers’ they don’t necessarily drive the initial choice, but they are absolutely essential to prevent customer churn, even if your coffee is exceptional.

The rise of the informed home barista

More than a third of café drinkers now own a home espresso machine. Many of them still buy beans from cafes. This group understands grind, extraction and freshness. They know when a coffee is well made. They are not comparing cafes to other cafés. They are comparing cafés to what they can make at home.

The consumer’s true definition of ‘specialty’

We confirmed that 59 per cent of Australians are aware of the term “specialty coffee,” but the real insight lies in what they associate with it. Consumers are focused on tangible benefits:

1. High quality beans: This was the most frequent association by far, linking the term directly to raw ingredient quality.

2. Unique flavours: Consumers expect specialty coffee to offer a more complex and refined taste experience than a commodity brew.

3. Freshly roasted: The understanding that quality involves care from farm to cup, including recent roasting.

For cafés, this raises the bar. It also opens a door. Retail beans, education and transparency are no longer extras. They are part of the relationship. The takeaway is that the ‘specialty’ designation works as a quality shortcut. Customers are signalling they are looking for a guaranteed superior experience. By focusing your communications on the tangible proof points (the origin, the unique flavour notes, the freshness of the roast) you effectively justify the premium price point and connect directly with the customer’s core understanding of value.

The power of the upsell: Add-ons and alternatives

Finally, for specialty cafes, the opportunity to diversify revenue streams is clear, extending from the coffee itself to alternatives and customisations.

The $1.00 rule for customisation: The market has firmly established its expectations for add-ons. While we noted the median price consumers are willing to pay for an alternative milk or an extra shot is $1.00, this is a critical psychological anchor. Pricing add-ons at this level allows consumers to feel they are customising their drink without incurring a significant penalty.

Matcha rises to rival chai: When looking at beverages beyond coffee, Black/Green Tea (45 per cent) and Hot Chocolate (33 per cent) remain popular. Crucially, newer cafe staples like Matcha (18 per cent) have quickly grown to rival Chai (18 per cent) in popularity. This shift suggests a growing segment of customers looking for health conscious, quality driven non-coffee alternatives.

For café owners, this data provides the confidence to diversify. Your commitment to exceptional quality should extend beyond the espresso machine. Investing in high-quality matcha, chai and hot chocolate ingredients is not an after thought it’s an essential strategy to capture a greater share of spending from diverse customer groups.

What this means for cafés

The data tells a consistent story. Australians care deeply about coffee. They notice quality. They respond to honesty. And they are more flexible on price than many assume, when value is clearly communicated. The challenge is not just setting the right number. It is helping customers understand why that number exists. When cafes lead with quality, consistency and context, price stops being the enemy and starts becoming a signal of value. That is the opportunity ahead.

Click here for the full report.

Article written by Abdullah Ramay, CEO of Pablo & Rusty’s Coffee Roasters. Abdullah is a purpose-driven leader and technology enthusiast, uniting business strategy, leadership, and innovation to create meaningful impact in the specialty coffee industry.

Article originally published on the Pablo & Rusty’s website. For more information, click here.